PLOTIO GLOBAL

Finance

【Morning session】Multi Party Hold All Advantages Gold Price Rises Continuously

Gold:

The market has gradually accepted the expectation that the Federal Reserve (Fed) will cut interest rates twice this year, which is the key factor behind gold's strong rally over the past seven weeks or so. Additionally, amid tense geopolitical situations and concerns that a potential long-term U.S. government shutdown might weigh on economic performance, gold prices have been supported to move further higher.

According to the CME FedWatch Tool of the Chicago Mercantile Exchange, the probabilities of the Fed cutting interest rates by 25 basis points in October and December stand at 94.1% and 83.9% respectively.

Furthermore, U.S. President Donald Trump stated that negotiations with congressional Democrats to end the partial government shutdown have reached a deadlock, and the White House may lay off a large number of federal employees.

Mai Dong, an Investment Strategist at Zhisheng Research, believes that as gold prices keep refreshing historical highs, gold has entered a "game for the brave" phase, and investors should be vigilant against a pullback.

Technical Analysis: On the daily chart, a bullish candle was closed yesterday. At the 1-hour level, the market is moving upward strongly. The lower support level to watch is $3,935, and the upper resistance level is $3,990.

Gold hourly chart

Gold hourly chart

Crude Oil:

After resolving their stance differences, Saudi Arabia and Russia reached an agreement, and OPEC+ agreed to a slight increase in crude oil production in November.

On October 5 (local time), OPEC+ announced that eight oil-producing countries within the organization will further increase production by 137,000 barrels per day in November, which is the same as the production increase in October and far lower than the 500,000 barrels previously reported by the media. This moderate production increase has helped oil prices stage a slight rebound.

Currently, Russia is more inclined to defend oil prices, while Saudi Arabia focuses more on market share. A representative stated before the meeting on Sunday that Russia supports a cautious production increase, while Saudi Arabia favors a larger supply increase. Eventually, Saudi Arabia and Russia overcame their differing positions and reached a consensus.

The slight production increase agreed upon by the two sides indicates that OPEC+ has taken a cautious move, enabling the organization to maintain stability between preserving market stability and regaining market share in an environment of oversupply.

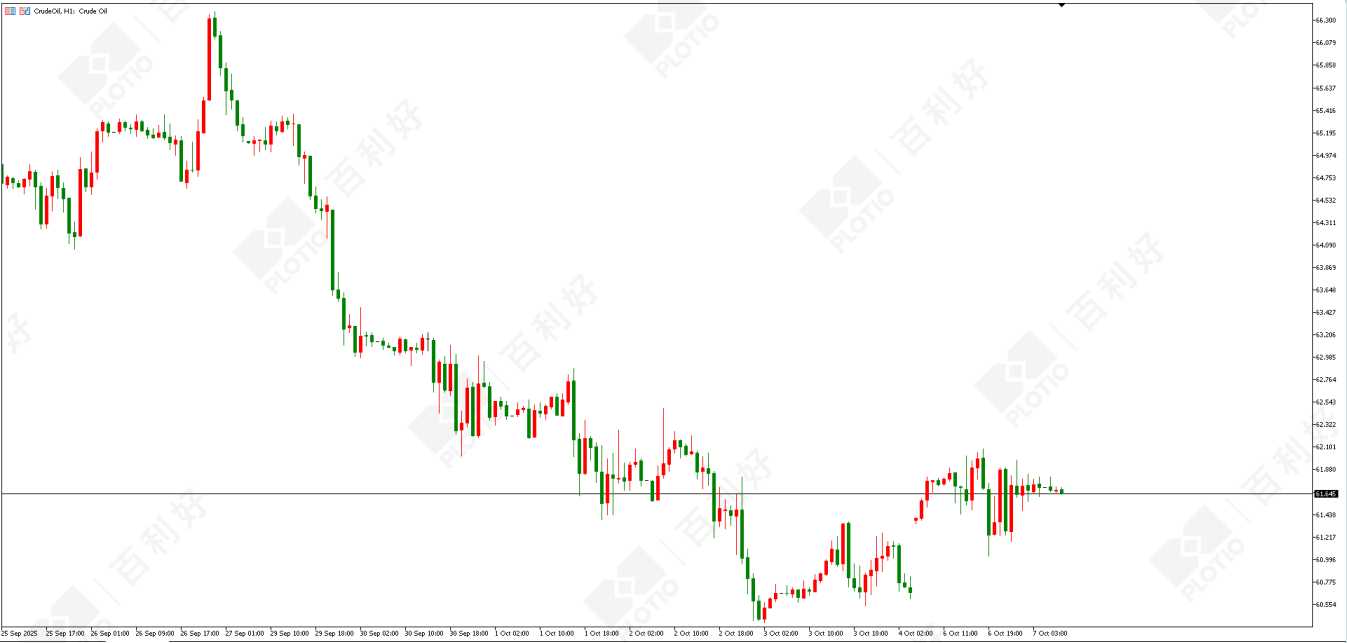

Technical Analysis: On the daily chart, a bullish candle was closed yesterday. At the 1-hour level, the market may stage a trend reversal. Today, the lower support level to watch is $60.90, and the upper resistance level is $62.20.

Crude oil hourly chart

Crude oil hourly chart

NASDAQ Composite Index:

On the daily chart, a bullish candle was closed yesterday, and the market once again refreshed its all-time high, reaching 25,035. At the 1-hour level, the market moves along the 60/120-day moving averages, maintaining an upward trend. However, the momentum of hitting new highs has weakened, so investors should be alert to a market pullback. Today, the lower support level to watch is 24,850, and the upper resistance level is 25,150.

U.S. Dollar Index (DXY):

On the daily chart, a bullish candle was closed yesterday. At the 1-hour level, the market is fluctuating within the range of 97.40-98.50. Today, the lower support level to watch is 97.90, and the upper resistance level is 98.50.

Important Statement:

The above content and views are provided by the third-party partner platform, Zhisheng, for reference only and do not constitute any investment advice. Investors operate at their own risk based on this information.

This article is from Plotio; please cite the source when reprinting.

【In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.】

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live